Many moms and dads will tell their kids to get a job if they want to purchase, let alone insure, a car. That's not a bad idea, however do not let the high rate of guaranteeing a teenager intimidate you.

The outcomes will shock and perhaps even confuse you. A credit therapist will assist you stabilize your budget and can address some concerns you might have about financial obligation consolidation or how to save cash.

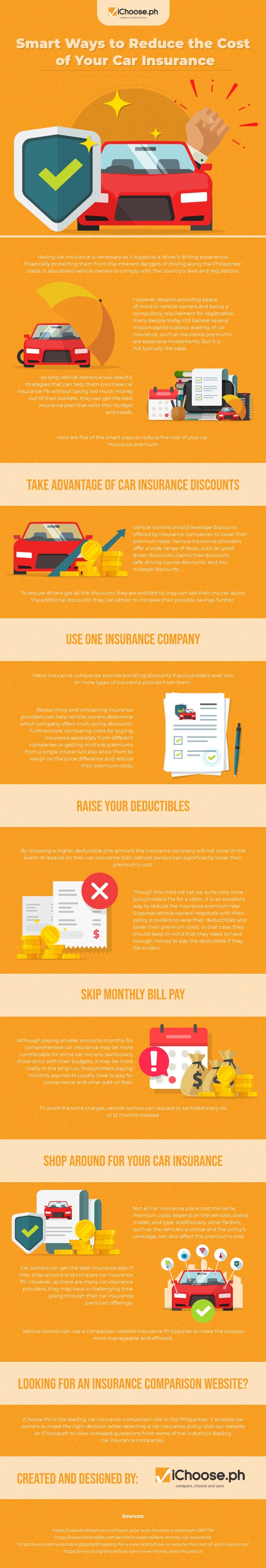

Cars and truck insurance coverage is a typically neglected cost where you could find some significant savings. There are numerous things you can do both today and with time to reduce your automobile insurance coverage payments. Cars and truck insurance coverage rates differ substantially from company to business for similar coverage levels. When it's time to restore your policy, get quotes from several business to make certain you're getting the very best deal.

The Best Strategy To Use For 18 Ways To Lower Your Car Insurance Premiums In 2021

If you take a trip less than 5,000 miles each year you could save money on your insurance coverage policy. There are lots of advantages to having a good credit report consisting of decreasing your insurance coverage rate. According to Wallet, Hub there is a 49% difference in the expense of vehicle insurance for someone with excellent credit compared to chauffeurs without any credit history.

Insurance coverage products provided through VACUIS and SWBC are not a deposit of or ensured by a cooperative credit union or cooperative credit union affiliate, and might decline.

The more comparisons you make, the better opportunity you'll have of saving money. Each insurer has its own formula for calculating cars and truck insurance coverage rates. They place different levels of significance on such aspects as the type of car you drive, yearly mileage, your age, your gender, and where you garage your automobile(s).

Facts About How To Reduce Your Auto Insurance Premiums Uncovered

For instance, comprehensive defense pays to fix vehicle damage from accidents aside from accidents, such as vandalism or fire. If you desire this kind of defense, you must buy a policy that includes this coverage. You'll miss an opportunity to cut vehicle insurance expenses if you don't inquire about discounts.

If you have a low credit report with the 3 significant credit bureaus Equifax, Experian and Trans, Union you may be penalized. Many insurance companies depend on credit bureau details when producing their own credit-based insurance ratings for customers. A great way to improve your credit history is to pay your bills on time.

Evaluation your credit reports carefully to make certain they do not include errors. Know that not all states permit insurance providers to use credit information to compute vehicle insurance rates. According to the Insurance Coverage Info Institute, mentions that limit the use of credit report in auto insurance rates consist of California, Hawaii, and Massachusetts.

How 5 Ways To Help Lower Auto Insurance Rates - Military.com can Save You Time, Stress, and Money.

used car, think about the reasons for the purchase. Some aspects to consider before buying a hybrid cars and truck include whether to buy used and if you will qualify for insurance discounts. There are numerous aspects to think about when including another car to your automobile insurance. Leading Stories Competitive and negligent driving put all motorists on the roadway at threat.

We love automobile insurance! That's why we're sharing our favorite tips for how to lower cars and truck insurance coverage expenses. We'll begin by taking a look at the real expense of automobile insurance coverage.

How Much Does Automobile Insurance Cost? You can't manage all of themlike state laws or your age. You can take steps to decrease your cars and truck insurance coverage.

Little Known Facts About How To Lower Car Insurance Premiums - Jerry.

You're not wed to your automobile insurance coverage policy. Or your current business might be willing to cost match a much better deal to keep your business.

(If your vehicle is over ten years old, some insurance providers will not use you these coverages anyhow, because of its decreased worth.) With all that stated, the something you must never cut back on is liability insurance coverage. Repair work and medical costs can cost hundreds of countless dollars after a mishap.

A lot of folks get so captured up in the bells and whistles of a brand-new car that they forget how much it will cost to insure. Given that brand-new cars and trucks are more costly to fix and replace, they'll make your insurance premiums increase.

The smart Trick of How To Lower Car Insurance After An Accident Or Ticket That Nobody is Discussing

So if your SUV or pickup is simply a gas-guzzling status sign that you don't really need, swap it out for a sedan. And before you buy, call your insurance company. They can inform you how the car you're thinking about will impact your rates. If you do not like what you hear, you can pick a various car.

Insurance coverage companies like when you make their task much easier, and they'll thank you with discounts and lower premiums. One way to do that is to alter how (and when) you pay for your insurance coverage.

If you drive like a moron, you're going to pay more for insurance. If you desire to know how to decrease your vehicle insurance, you can begin by looking in the mirror. When somebody tells you that you need to construct your credit to save on car insurance, they're really informing you to take on more financial obligation, pay more cash in interest and tie up more of your income in regular monthly payments.